PRS is a voluntary investment scheme to help you save for retirement. A pension fund also known as a superannuation fund in some countries is any plan fund or scheme which provides retirement income.

Helpful Tips For A Successful Unit Trust Investment

Government securities held as.

. Public Mutual Berhad a wholly-owned subsidiary of Public Bank is a top private unit trust management company and leading PRS provider in Malaysia. Structured Product Investment. Public Mutual is also an approved private retirement scheme PRS provider managing nine PRS funds.

We also provide customised mutual fund ranking to wealth managers distributors private banks and advisory firms. Earlier pension systems in the country used to be provided only by employers ie. Private and public employers.

Public Mutual Online Registration. A private equity fund is a collective investment scheme used for making investments in various equities and debt instruments. Schroder UK Public Private Trust plc the Company has appointed Link Fund Solutions Limited AIFM as alternative investment fund manager under AIFMD to.

A fund is a source of money that is allocated for a specific purpose. 78 Jalan Raja Chulan 50200 Kuala Lumpur Malaysia. How a Democrat-controlled US government could impact private equity.

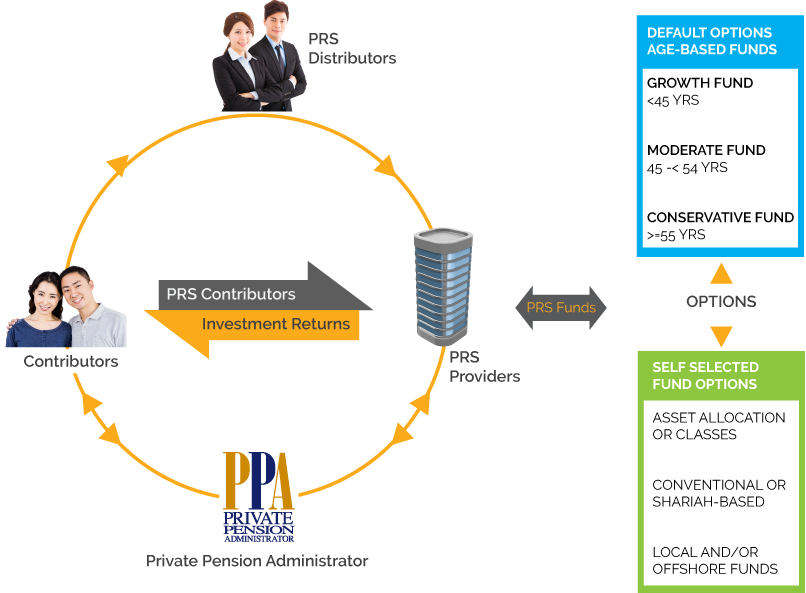

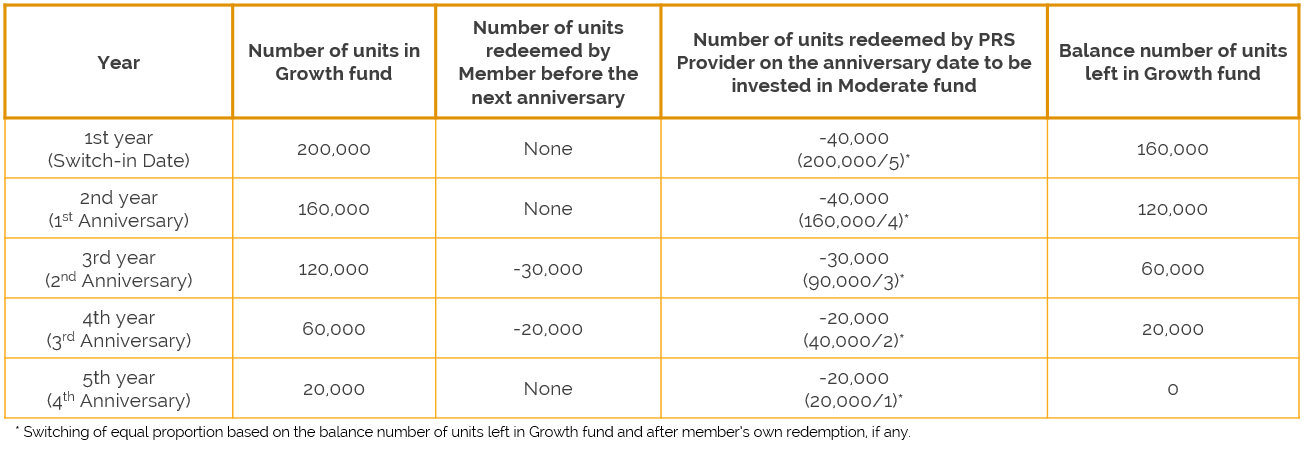

How private equity can unlock value in technology. Under the scheme you can invest in approved unit trust funds that are managed by PRS providers Public Mutual Kenanga etc. Make investment easy with PGIM India Mutual Fund.

The returns are guaranteed in the form of monthly income payments. Unit Trust Private Retirement Scheme. Public Mutual Berhad 197501001842 23419-A Menara Public Bank 2 No.

Asset include public and private fixed income public equity both fundamental and quantitative and real estate. A large part of the success of mutual funds is also the advantages they offer in terms of diversification professional management and liquidity. Also it is a 0 risk investment option.

Aansh Malhotra would need Rs 454 Cr at the time of his retirement. But new pension scheme introduced by the government is a flexible mode of retirement scheme in which any individual in the country can start investing towards retirement fund. Gold Monetization Scheme is intended to mobilise the idle gold lying in households institutions corporates temple trusts of the country and facilitate its use for productive purposes and in the long run to reduce countrys reliance on the import of gold.

ESG-linked fund finance sustainability step-change or window. Post office monthly income scheme MIS is a safe investment option. CRISIL Mutual Fund Ranking CMFR is highly popular among investors intermediaries and asset management companies AMCs.

What is a Private Retirement Scheme PRS. List and Address For. It has a total of 31 branchescustomer service centres nationwide.

He can invest Rs 1515 lakhs as a one-time investment or invest Rs 167 lakhs yearly for the next 29 years or invest Rs 147K monthly for 29 years 11 months to get the desired amount at the time of retirement. The Private Pension Administrator Malaysia PPA serves as the central administrator of PRS. Share Trading Margin Financing Let us help you grow your wealth.

We offer a comprehensive range of products comprising conventional and Shariah-based unit trust and PRS funds as well as financial planning services. Federal Farm Credit Bank FFCB is a GSE thus carrying an implicit guarantee on its debt while Private Export Funding Corp. The democratisation of private markets is under way.

Mutual funds give you the ability to easily invest in increasingly complicated financial markets. He is also a Trustee Director of the Schroders Retirement Benefit Scheme and is a member of its Investment Committee. A fund can be established for any purpose whatsoever whether it is a city government setting aside money to build a new.

What is the amount of corpus you want at retirement if you were to retire today. They are usually managed by a firm or a limited liability partnership. The tenure Investment horizon of such funds can be anywhere between 5-10 years with an option of annual extension.

Also the investors can wish to reinvest in the scheme if they want to. Single account and joint account. PEFCO bonds are backed by US.

Pension funds typically have large amounts of money to invest and are the major investors in listed and private companies. 1800 266 7446. This is easily the best investment scheme in the country.

CRISIL is a front runner of the mutual funds research services industry in India. Behind the latest PE and private debt fundraising numbers. They are especially important to the stock market where large institutional investors dominate.

Gold eGold Investment Account. Mutual Funds could be Equity funds Debt funds floating rate debt or balanced funds. 03 2022 6900 E-mail.

The scheme comes with a lock-in period of 5 years. In the NPS scheme the subscribers can make a minimum contribution of Rs6000 in a financial year which can be paid as lump-sum or as. 03 2022 6800 Facsimile.

The National Pension Scheme also known as National Pension System is opened to all the employees from the public sector private sector and even the unorganized sector except for those who work in the Armed Forces.

Prs Provider Public Mutual Berhad Private Pension Administrator Malaysia Ppa

A Guide To The Private Retirement Scheme Prs

Structure Of Prs Private Pension Administrator Malaysia Ppa

Investments School Employees Retirement System Ohio Sers

Awards Celebration Campaign 2022

A Complete Guide To Prs Malaysia Private Retirement Scheme Youtube

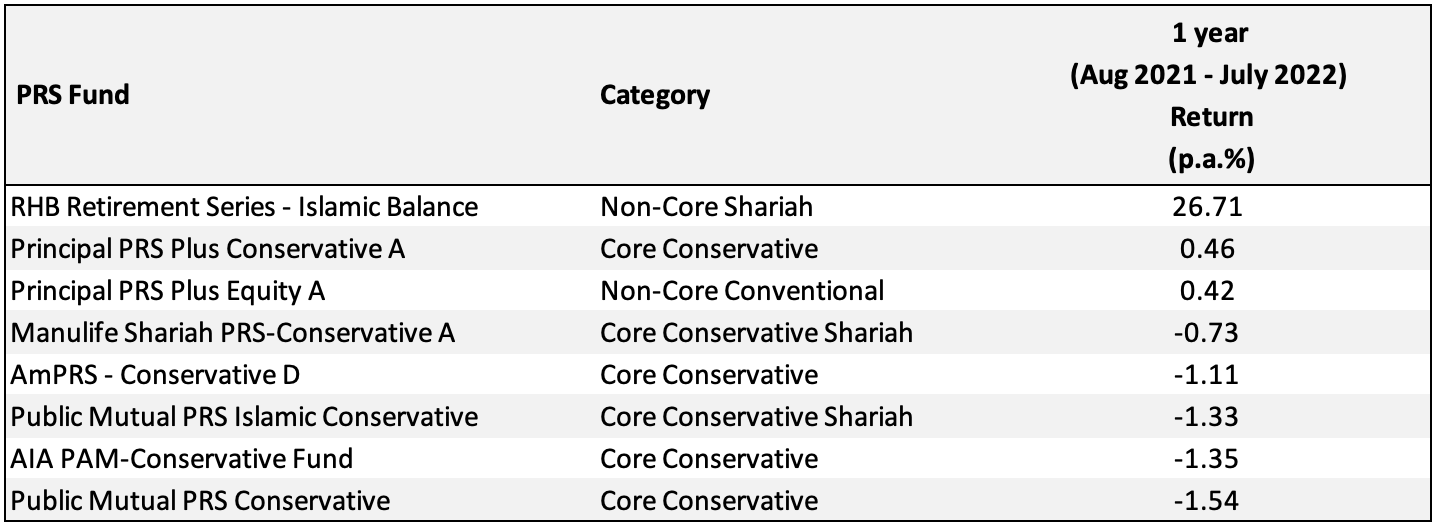

Which Prs Funds To Invest In 2020 2021 Mypf My

Public Bank Berhad Unit Trust Private Retirement Scheme

Cover Story Is Prs Outperforming Epf The Edge Markets

5 Best Mutual Funds For Your Retirement Trading At 10 20 Discount

Structure Of Prs Private Pension Administrator Malaysia Ppa

Prs Funds Information Private Pension Administrator Malaysia Ppa

Structure Of Prs Private Pension Administrator Malaysia Ppa